18 Jan ASEAN – A rising star in a post-pandemic world

The year 2020 left the world grappling with a pandemic-induced recession, and the ASEAN member states too, are subjected to this economic downturn. However, as we progress into 2021, with vaccines on the horizon, it is important to take a look at the future prospects of each ASEAN economy, and how they might bounce back in a post-pandemic world.

UK’s Centre of Economic and Business Research (CEBR) recently published the 2020 World Economic League Table in December 2020, highlighting ASEAN as a high growth region. This could be attributed to several factors including (but not limited to) the region’s growing middle class, increasing digital penetration across its population, rising average income levels, and the region’s increasingly important role in global supply chains.

Covid-19 has affected long term GDP growth and economic momentum globally, with Asia doing best and Europe worst. Globally, severe impact will be seen on rising government debt, interrupted global supply chains and slowing consumer demand. However, it has also heralded a momentum in scientific research unheard of in the past, in way of vaccine development. A widespread availability of vaccine will help restart global growth stories especially in the ASEAN region which is expected to come out of this pandemic relatively unscathed.

The table below displays the predicted average annual GDP growth rates of some ASEAN economies over the 2021-2025 period, as per the above mentioned report.

| Country | Forecasted Annual Growth Rate (2021-2025) |

| Malaysia | 6% |

| Indonesia | 5.4% |

| Singapore | 3% |

| Philippines | 6.7% |

| Cambodia | 7.1% |

| Vietnam | 7% |

| Myanmar | 6.2% |

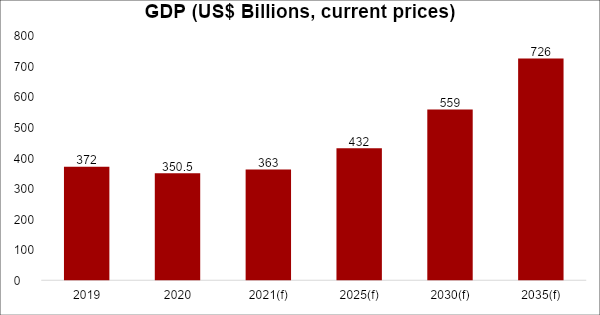

Singapore – The Lion City, though one of the most secure and virus-free places in the world today, has had a slightly unsteady journey through the pandemic. Having contained the virus well in initial months, Singapore experienced a sudden and rapid rise in cases during the summer, and this prompted a nationwide lockdown that lasted till the end of June. As an economy that is heavily dependent on entrepot trade and travel, the pandemic predictably had a significant impact on Singapore’s economy, with its GDP shrinking by 5.8% in 2020. However, there is reason for optimism on the horizon. Given that the domestic and global economy are opening back up and the government is implementing policies to raise employment and productivity, the report by the Centre for Economics and Business Research predicts that over the next five-year period Singapore’s GDP is set to grow at an average of 3%, after which it will slow down slightly to an average of 2.5% per year between 2026 and 2035. As exhibited in the figure below, the Singaporean economy is expected to show steady growth in the long run, with GDP reaching USD 726 billion by the year 2035.

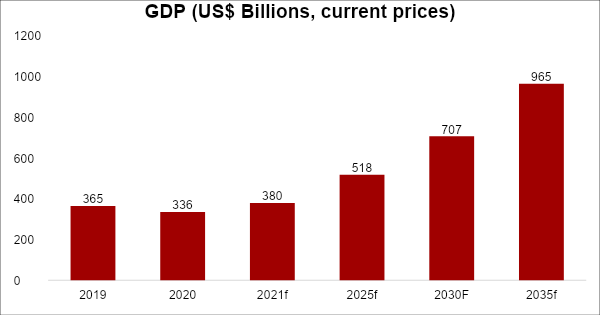

Malaysia – Among the easiest places in the world to do business (given that Malaysia ranks 12th out of 190 countries in the World Bank’s Ease of Doing Business ranking), Malaysia is one of the leading economies in Southeast Asia, but it too bore the brunt of the COVID-19 pandemic. According to Asia Pacific Investment Bank (APIB) the Malaysian economy is expected to contract by 6% in 2020, owing in large part to a contraction of over 17% (Y-o-Y) in Q2 of 2020. Despite this economic blow that Malaysia has suffered at the hands of the pandemic, it is expected to make a resurgence in 2021, with the country’s Finance Ministry projecting growth between 6.5%-7.5%. Furthermore, the Malaysian economy is forecast to exhibit continued growth in the years to follow – with a projected average annual growth rate of 6% between 2021 and 2025, and an average growth rate of 4.5% between 2026 and 2035. This growth could eventually see the Malaysian economy grow to USD 960 billion by 2035, as showcased in the figure below.

Indonesia – ASEAN’s largest economy has had the regions highest number of Covid19 cases. However, given the challenges associated with a massive population, it has weathered the pandemic with relative efficiency compared to other populated countries such as India. Also, the number of cases/million population has been on the lower side when compared to other ASEAN countries such as Singapore.

Indonesia’s government has introduced a COVID-19 related package worth 4.3% of GDP to boost the economy. With Indonesia stepping into a post-pandemic world, President Jokowi and his government are prioritising the country’s economic stability and are thus taking measures to improve its overall business and investment climate. A very recent example of this is the passing of the Omnibus Law on Job Creation which through its broad ranging reforms aims to increase investment flows to the archipelago, and in doing so aims to spur sustainable economic growth for Indonesia.

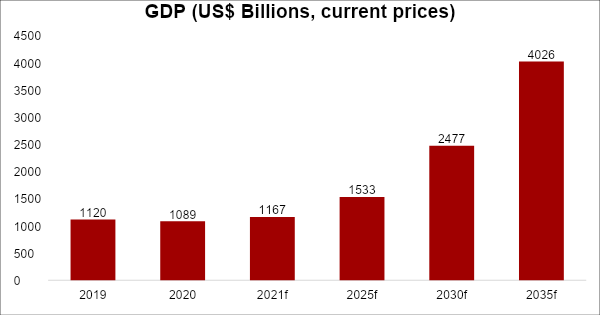

While the GDP has contracted by 1.5% in 2020, the Indonesian economy is set to witness strong growth over the next five years, with average annual growth reaching 5.4% between 2021 and 2025. In the subsequent ten-year period growth will decrease slightly but still remain stable with GDP growing at an average annual rate of 5.3%. Through such sustained growth Indonesia could eventually cross the USD 4 trillion mark by 2035, as illustrated in the figure below.

Vietnam – This rising economic heavyweight has tackled the pandemic with astounding efficiency thus far. Despite having a population of over 96 million people, Vietnam has recorded only 1505 COVID-19 cases and 35 virus related deaths as of 7th January, 2021. The country’s prowess in containing the spread of the virus has also been reflected in its economic performance for the year.

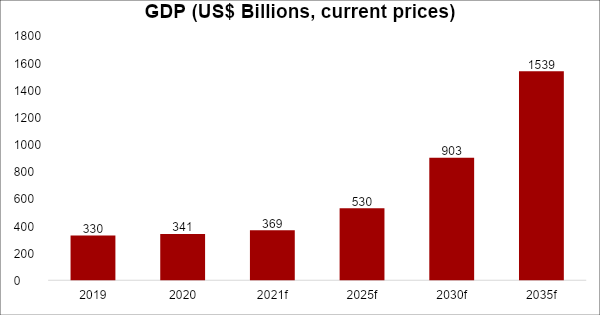

According to estimates by the Centre for Economics and Business Research, its economy expanded by 1.6% in 2020. This is particularly impressive in a year where most economies have struggled to accomplish growth due to the pandemic. And further growth is expected in the future. As per the report by the Centre for Economics and Business Research, the average annual rate of GDP growth is predicted to rise to 7% between 2021 and 2025. Furthermore, in the following ten years from 2026 to 2035, the country’s GDP is predicted to grow at an average annual rate of 6.6% per year. This sustained growth could be spurred by multiple factors such as increasing digital penetration and connectedness in the country, a shift in global manufacturing and supply chains as companies look for a ‘China plus one’ strategy, and increasing global connectivity through the ratification of trade agreements like the recently passed RCEP and the FTAs inked with EU and UK at the end of 2020.

As Vietnam’s economy continues to witness strong and stable growth, its GDP could eventually grow to a mammoth USD 1.54 trillion by 2035, as showcased in the figure below.

It is, however, important to note that the predicted figures below (acquired from the report by the Centre for Economics and Business Research) do somewhat differ from forecasts by the Economic Intelligence Unit, which has an even more optimistic view of the Vietnamese economy. For example, the EIU predicts that Vietnam’s GDP will reach US$ 557 billion by the year 2025. Though this is higher than CEBR’s prediction, the difference itself is not drastic.

Thailand – The pandemic, by virtue of the global travel restrictions it has brought on, has had a rather targeted impact on the Thai economy which is heavily dependent on the travel and tourism industry. The tourism sector constitutes 15% of Thailand’s GDP and the severe blow that it has suffered during 2020 has of course had a significant effect on Thailand’s economic performance.

Though Thailand had efficiently tackled the spread of COVID-19 for the majority of last year it witnessed the outbreak of a second wave in December and is currently striving to contain a further spread of the virus through the country.

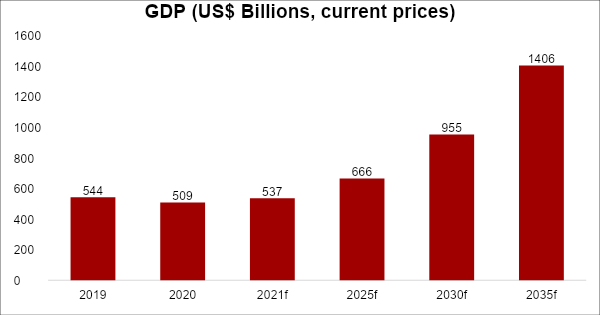

Thailand’s economy is expected to shrink by over 7% in 2020, but as vaccines become more widely available and countries open their borders in a bid to recover economically the consequent resurgence of global tourism is expected to help Thailand bounce back in 2021 with 4% GDP growth. As illustrated in the figure below, in a post pandemic world Thailand is projected to witness stable, continued growth which will propel its GDP past USD 1.4 trillion by the year 2035.

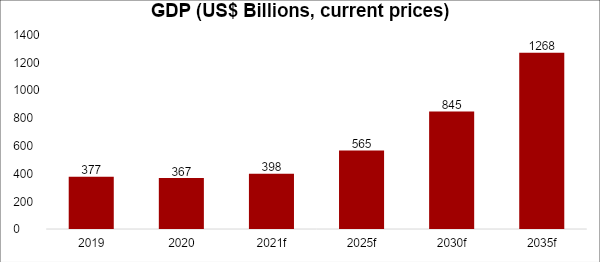

Philippines – The virus has taken its toll on Philippines, which has recorded nearly 480,000 cases of the virus thus far. From an economic standpoint as well, a GDP decline of 8.3% for the year 2020 has been predicted. Additionally, the economy has seen government debt as a share of GDP increase from 37% in 2019 to 48.9% in 2020. Despite the brunt of the virus the Philippines is expected to prove its resilience and bounce back in a post pandemic world. Projections peg the average rate of GDP growth from 2021-2025 at 6.7%. Furthermore, in the subsequent 10 years between 2026 and 2035, economic growth is expected to remain stable with an average annual growth of 6.5%. As shown in the figure below, strong and stable continued growth will eventually see the Philippines’ economy surpass the USD 1 trillion mark and reach USD 1.2 trillion by the year 2035.

Cambodia – Despite having a population of nearly 16.5 million people, Cambodia has recorded only 385 COVID-19 cases as of 7th January 2021, and has not recorded a single death from the virus either. That being said, Cambodia has not been completely immune to the economic impact of the pandemic.

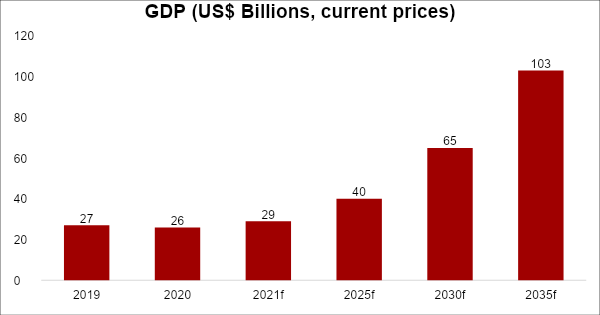

Cambodia’s economy shrunk by 2.8% in 2020 and government debt to GDP increased to 31.5% from 28.6% the previous year. However, the country is expected to bounce back with great vigour in the years to come. Between 2021 and 2025, the country’s GDP is expected to grow at an average annual rate of 7.1%. And even in the 10 years post this (from 2026 to 2035) growth is expected to remain strong, with the average annual GDP growth rate pegged at 6.6% during this period. Furthermore, as showcased in the figure below, a strong and steady rate of growth could eventually see the Cambodian economy surpass the USD 100 billion mark.

Myanmar – A young democracy with potential in spades, the country of Myanmar has been stirring excitement among foreign investors for some time now, and there is much reason to be optimistic about the nation’s future prospects. Its large population of over 50 million people, and its increasingly democratic political system (especially in the wake of the 2020 general election) make it an interesting potential investment destination for foreign investors. Furthermore, Myanmar is on the short list of countries whose economies did not contract in 2020 due to the pandemic, a rather commendable feat.

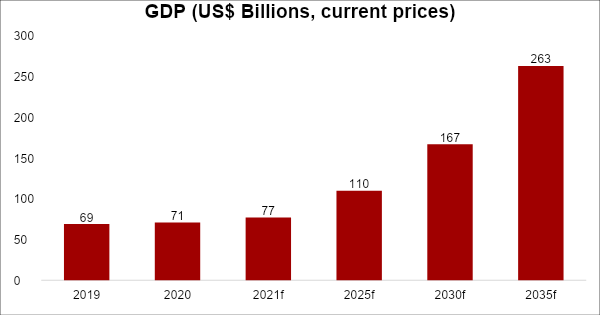

Estimates suggest that the Myanmar economy grew by 2% in 2020, down from 6.5% the year before. However, the rate of growth is expected to pick up again in the years to come. According to the report published by the Centre of Economic and Business Research, Myanmar’s average annual GDP growth rate between 2021 and 2025 will hit 6.2%, and over the ten-year period to follow (from 2026-2035) the average annual GDP growth rate is predicted to be 6.5%. This strong growth that Myanmar is projected to witness could see the economy grow to US$ 263 billion by 2035, as illustrated in the figure below.

Reason to cheer

All in all, the ASEAN region appears to be the emerging hotspot in global trade and economic prowess. A moment of glory that needs to be grabbed by both hands by a region which has been burdened with issues relating to large population, volatile natural geographies, sensitive ecology and shifting geo-politics. Steady governance, disciplined trade and foreign policy initiatives, and focussed improvements in education and healthcare will ensure the region shines through in the new decade .