05 Aug COVID-19: Global pandemic to endemic disease – at best

Let’s re-cap

The COVID-19 pandemic rolls on 20 months since it started. Our world hasn’t ended, but nor is it remotely approaching normal. Let’s re-cap, re-assess and consider the future for Asia and ASEAN. We’ll look at the global pandemic’s waves to date; some (terrible) statistics, particularly vaccinations; then re-focus on the commercial outlook for ASEAN and a changing future for all of us.

Riding the waves of a global pandemic

The pandemic began in Asia early in 2020 yet its first wave mostly impacted Europe and the developed world. Asian societies seemed better-suited to control the pandemic initially with effective testing, lockdowns and disease control. By contrast, many in Europe and (more so) USA initially failed to recognize the disease’s severity, so policies and outcomes varied. The 1st wave peaked in the West in April 2020. A global 2nd wave followed during the northern hemisphere winter, peaking in January 2021. This was felt more evenly globally, with vaccination rates impacting positively selective countries and regions. By the peak of a 3rd wave in May 2021, it was mainly less developed, less wealthy and less vaccinated regions and countries which were worst affected. These wave patterns and underlying vaccination trends don’t augur well for ASEAN.

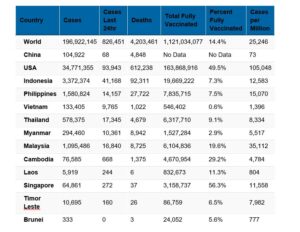

Table: COVID cases and status at 30 July, 2021 / Johns Hopkins University and Southeast Asian Health Ministries:

Currently <15% of the world is fully vaccinated against this disease. Broadly, Europe and the USA have vaccinated about half their populations (or two-thirds of adults) whereas most ASEAN nations remain <10% fully vaccinated. Smaller, richer Asian countries (eg, Singapore at 49%) have managed much better; but vaccination in larger, poorer nations (India, Indonesia) at <10% is below even the global average. Curiously, vaccination rates don’t map perfectly to wealth or population size: Australia and New Zealand remain at <15%.

Vaccination dramatically weakens the link between COVID infection and death, although with less efficacy against the coronavirus Delta variant which is spreading rapidly. 99% of sequenced cases in Indonesia, for example, are Delta.

Published statistics tend to dampen the true impact of disease. COVID’s impact on India is “catastrophically worse” than recognized according to the country’s own former chief economic adviser, Arvind Subramanian. India has acknowledged just 414,000 COVID-19 deaths but, according to Subramanian, “what is tragically clear is that people in the millions have died”. So-called “excess deaths”, above historical mortality, are running at 7–10 times higher than reported COVID deaths in India since the start of the pandemic, according to his study1, offering a yardstick for populous ASEAN.

New wave patterns

Future coronavirus variants may “escape” current vaccination efficacy, and COVID-19 remains a global disease. But if vaccination rates affect future waves of cases and mortality, then surely the commercial impact will differ too in different regions. Low vaccination rates in ASEAN, rising only slowly, cast a shadow over economic forecasts which have generally been pulled back. If governments are lowering national economic forecasts like GDP growth, then corporates may need likewise to react. This is sector-dependent but many observers believe that equity markets generally remain too stretched, especially in those markets adversely impacted by on-going, or deteriorating, pandemic issues and restrictions.

Even in the more vaccinated West, recent talk about expansionist macro policy and ongoing monetary easing leading to inflation has been reined in: 10-year U.S. Treasury yields have lately retreated to under 1.3% from above 1.7% in March. Instead of inflation fears, talk in the western financial press has returned to secular stagnation… if this is cautious sentiment in vaccinated western markets, then what chance for unvaccinated ASEAN? Gita Gopinath, the IMF’s chief economist, recently highlighted a “dangerous divergence” between advanced and developing economies with limited access to vaccines.

Consequences for commerce

Travel and tourism are among sectors worst impacted in ASEAN, drastically curtailing activity for airlines, hotels and transport; and knocking on to spending on retail, entertainment, F&B. Other sectors partly compensate (healthcare, tech, digital). Yet behind cold statistics lie literally millions of people whose families have been impacted by underemployment, redundancy, social restrictions, illness and tragically death. Worse, in much of ASEAN, without the safety net of welfare or furlough payments to support them through the hardship. This is hardly the springboard for some great Asian economic revival.

A future timeline?

From COVID-19, “no-one is safe until everyone is safe”. Even if no disease variants develop (which they will) and vaccination affords complete protection (which it won’t) then only 14% of our planet’s population is currently safe. That leaves 86% of the global population of 7.8bn, or 6.7bn people, currently unsafe. Historical global pandemics rolled on for years, not months. Let’s be realistic about what all this means for citizens, their countries and regions – and the dynamics of trade and commerce within and between them. Like life, commerce for the survivors continues. But some people and businesses simply die; many others slow down; and all survivors will continue to be impacted directly or indirectly. The best we can hope for is a benign COVID endemic for our future. Bear this in mind when the time comes around to prepare your annual business performance forecast for 2022 – and beyond.