- Home

- /

- Singapore-landing-2020

- /

- Singapore-Economy

GDP – In spite of having a small population of 5.7 million people (2019), it has a high GDP of US$ 510 billion, which is much larger than its regional peers. Its growth by 87% over the last decade is indicative of the income generating capacity of the people, which is further reflected in its GDP per capita.

Data sourced from the Department of Statistics in Singapore

GDP per capita – – US$ 65,233 (2014) –8th highest in the world

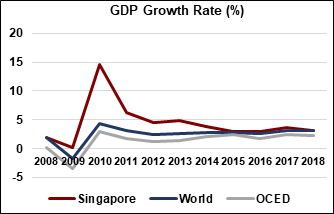

GDP Growth – Singapore’s GDP has grown by 3.13% in the most recent year of analysis (2018). Albeit it is low compared to its regional peers, given Singapore’s pre-existing capital position, a growth of 3% is also very high. Furthermore, it shows a high correlation of 0.77 and between its GDP growth rate with that of the world, only with less volatility.

GDP Per Capita Growth (%) – Singapore’s GDP per Capita grew by 2.66% in the most recent year of analysis (2018) with an average growth rate of 2.43%, thereby indicating economic stability. Keeping consistent with the nation’s GDP Growth Rate with a correlation of 0.92, the GDP per Capita Growth Rate does show certain volatility. However, upon further observation, it is worth noting that this growth has stabilized over the last five years and even though it has a declining trend, the latest two years have shown growth.

Consumer Spending – By having the 10th highest GDP per Capita in the world (2017), Singapore undoubtedly would have high consumer spending. As indicated in the graph below, the final consumption expenditure has increased by 74% over the last decade to US$ 165.61 billion which forms almost half its Gross National Income (GNI).

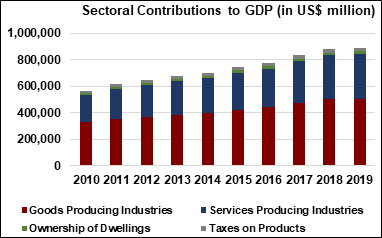

Sectoral Contributions to GDP – The contribution to GDP can be broadly segmented into Goods, Services, Ownership of Dwellings and Tax on Products. Its growing trend over the years has been given below.

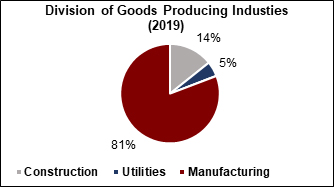

Goods Producing Industries – The producing sector mainly involving manufacturing and construction accounts for 25% of Singapore’s GDP (2019). The manufacturing industry has grown over the last decade to 81% of the goods producing industry, thereby highlighting the increasing manufacturing capabilities.

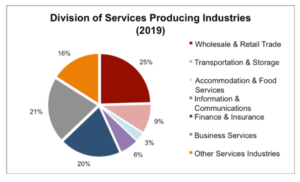

Services Producing Industries – The services producing sector is evenly divided among several spheres. Though these sectors have had a stable growth over the past decade, the Fintech & Insurance Sector grew at a higher rate, thereby making it a notable market segment to look at.

Primary Trade Partners – The trade partners of Singapore can be categorized as importing and exporting partners.

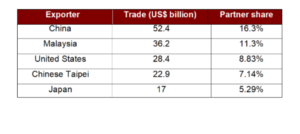

The top 5 export markets for Singapore (2019) are as follows:

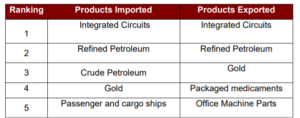

Sectoral contributions to exports – Singapore’s exports are evenly divided between its goods and services. The export in services forms 50% of its total exports. The other half of Singapore’s exports are reliant on goods. The top 5 goods imported and exported by Singapore (2018) are as follows

Export to GDP Ratio – Due to the nation’s small size and high population density, Singapore is heavily reliant on foreign trade. Therefore, it should be no surprise that the country has the highest trade to GDP ratio of over 300% (over the last 5 years) and an export to GDP ratio of 113% (2018).

Debt to GDP Ratio – Singapore’s debt to GDP ratio is at a high of 126.3% (2019). Though this is one of the highest in the world, the nation’s AAA credit rating indicates that the Singapore is managing its debt efficiently.

Trade Agreements – Due to Singapore’s high reliance on foreign trade, it is obvious that the state has implemented several trade agreements. The nation currently is a signatory of 25 trade agreements, which is one of the highest in the world (highest is 31) and is furthermore in negotiations for another 5 trade agreements.

Singapore’s Trade can be classified in the following groups

– Bilateral Trade Agreements

– Plurilateral Trade Agreements

– Country – Bloc Trade Agreements

– Bloc – Bloc Trade Agreements

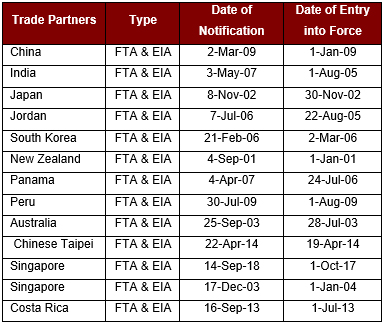

The following trade agreements are all under force.

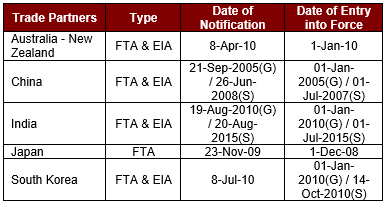

Singapore’s bilateral trade agreements are as follows

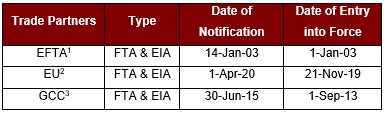

Singapore’s Plurilateral trade agreements are as follows

1European Free Trade Association (EFTA) – Iceland, Liechtenstein, Norway, Switzerland

2European Union (EU) – Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden, 3Gulf Cooperation Council (GCC) – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates

Singapore’s country – bloc trade agreements under ASEAN1 are as follow

1ASEAN – Brunei, Myanmar, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand, Vietnam

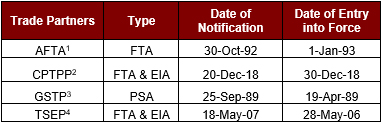

Singapore’s bloc agreements are as follows

1ASEAN Free Trade Area (AFTA) – Brunei, Myanmar, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand, Vietnam

2Comprehensive and Progressive Agreement for Trans – Pacific Partnership (CPTPP) – Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam

3Global System of Trade Preferences among Developing Countries – Algeria, Argentina, Bangladesh, Bolivia, Brazil, Myanmar, Cameroon, Sri Lanka, Chile, Colombia, Cuba, Benin, Ecuador; Ghana, Guinea, Guyana, India, Indonesia, Iran, Iraq,North Korea, South Korea, Libya, Malaysia, Mexico, Morocco, Mozambique, Nicaragua, Nigeria, Pakistan, Peru, Philippines, Singapore, Viet Nam, Zimbabwe, Sudan, Thailand, Trinidad and Tobago, Tunisia, Egypt, Tanzania, Venezuela

4Trans – Pacific Strategic Economic Partnership (TSEP) – Brunei, Chile, New Zealand, Singapore

(FTA – Free Trade Agreement, EIA – Economic Integration Agreement, PSA – Preferential Trade Agreement)

The following FTAs are under negotiation

– ASEAN-India (Services & Investment)

– ASEAN-Japan (Services & Investment)

– Eurasian Economic Union – Singapore Free Trade Agreement (EAEU)

– Pacific Alliance – Singapore Free Trade Agreement

– Regional Comprehensive Economic Partnership.