18 Feb Under the Chinese influence : Emerging ASEAN and rising debt

China’s role as a debtor to the world has become increasingly prominent in past years. In fact, according to a report by Vox, estimates suggest that debt from China (to the 50 most exposed countries) has risen from less than 1% of debtor country GDP in 2005 to over 15% in 2017. Furthermore, according to a 2020 article by Harvard Business Review, if one were to add up portfolio debts (including U.S. Treasury debt and trade credits) “the Chinese government’s aggregate claims to the rest of the world exceed US$ 5 trillion in total”.

Many developing nations have relied on China for financing to help accomplish and deliver key infrastructure projects. And they are are now heavily indebted to China. Emerging ASEAN has not been excluded from this trend. In this article we analyse the specific impact that Chinese debt is having on four emerging markets in ASEAN, namely Myanmar, Laos, Cambodia, and Brunei.

Myanmar

The country of Myanmar has been taking on tremendous amounts of debt from China, so much so, that in June 2020, Myanmar’s Auditor General publicly cautioned the government on the country’s continued reliance on Chinese loans. According to a report by the Economic Times, as of June 2020, 40% of Myanmar’s national debt (or US$ 4 billion out of a total of US$ 10 billion) was owed to China. There is now growing concern that this debt could begin to have a crippling effect on the Myanmar economy. Currently, Myanmar needs to repay as much as US$ 500 million to China each year (figure taken from the Economic Times) to cover principal and interest payments, and the country’s reliance on Chinese debt is only increasing. As a result of its participation in China’s Belt and Road Initiative (BRI), Myanmar has continued to take on new debt to finance its huge infrastructure projects. Given that these loans from China come at higher interest rates as opposed to loans from the World Bank or the International Monetary Fund, overreliance on Myanmar’s part could have an impact on its economic prospects in the future.

Laos

Another tale of debt obligation is originating out of Laos as we speak. There has, for a while, been growing talks surrounding Laos’ snowballing debt to China, and this was only exacerbated last year when Laos was forced to give up majority control of its national power grid to a Chinese company. Due to its growing debt obligations, much of it was owed to Chinese state banks. In recent years, Laos has pursued many capital intensive infrastructure projects that have been backed by China and, as per a 2018 report published by the Centre for Global Development, Laos is the one Southeast Asian nation at risk of significant debt distress due to the BRI loans it has received from China. It is also important to note that, as per an October 2020 report by the East Asia Forum, nearly half of Laos’ total public debt is held by China. All of these facts collectively indicate that Laos is perhaps over-reliant on Chinese debt. But how the country can steer itself around this debt, remains to be seen.

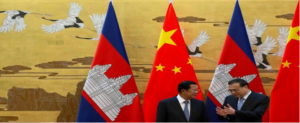

Cambodia

Chinese influence in the Cambodian economy has been following an upward trajectory over the past few years, and the economic fate of Cambodia now seems intertwined with that of China’s. As Cambodia’s largest military benefactor and foreign investor, China has had a very prominent role to play in Cambodia’s development thus far, and this relationship only seems to be getting stronger. Even in Cambodia’s political sphere, China has managed to cement its presence, having provided funds in 2016 to support the country’s election infrastructure. However, like its neighbours, Cambodia too has taken on a significant amount of Chinese debt, and it can count itself among the nations whose debt to China amounts to more than 25% of their GDP. There have been multiple instances where countries have taken on seemingly ‘no strings attached’ loans from China and then faced debt distress – having to cede control of valuable assets due to inability to repay loans. Though Cambodian Prime Minister Hun Sen has maintained that Cambodia is far from falling into any kind of Chinese ‘debt-trap’, questions have also been raised about the transparency and accountability surrounding Chinese loans to Cambodia. As relations between the two countries get stronger, it will be interesting to see the long-term impacts of Chinese debt in Cambodia.

Brunei

The oil-rich Southeast Asian country of just 420,000 people is a recent recipient of China’s interest, having volunteered its participation in China’s elaborate Belt and Road Initiative (BRI). Brunei has long been heavily dependent on its fossil fuel reserves, but there is growing realisation of the fact that the economy must become more diversified if it is to thrive in the long run. And it is with a view to this diversification that Brunei is now increasingly welcoming Chinese investment and cooperation. In recent years China has invested significantly into the Bruneian economy and has emerged as one of the largest investors in the country. Not only is China backing the Muara Besar refinery – the largest foreign investment project in Brunei’s history – but it is also backing the development of the Temburong bridge – the largest ever infrastructure project in Brunei. As per 2018 dated reports, China’s total investments in Brunei are estimated at US$ 4.1 billion, making it one of the largest investors in the country alongside the United Kingdom and Japan. Given Brunei’s relatively small size and overreliance on energy, it is particularly at risk of falling into a debt trap, but only time will tell how well the ASEAN nation is able to manage the benefits and risks of its increasing debt.