18 Jan Vietnam – An emerging FTA hotspot

While most trade analysts have been busy with a US-Sino trade war, Vietnam has quickly emerged as a dependable trade partner for some of the world’s most developed economies. And this feat is doubly celebrated as this was achieved in a world facing slow post pandemic recoveries and amid escalating trade war rhetoric. External factors such as regional geopolitics and Covid -19 related supply chain disruptions in 2020 have helped Vietnam in positioning itself as the go-to low-cost regional alternative to China for export-orientated manufacturing. However, a number of other factors have also contributed significantly to Vietnam’s growing weight as a trade partner:

- Lower production costs

- Focus on growing its network of trade agreements

- Existing member of global supply chains

- Robust road, rail and port infrastructure

- Strong internal policies such as promotion of special economic zones, tax incentives, privatisation process have helped promote the country as a global investment destination

According to the General Statistics Office of Vietnam, in the first 11 months of 2020, the country achieved a trade surplus of USD 20.1 billion. Exports grew by 5.4% to USD 254.6 billion compared to USD 263.2 billion for 2019 as a whole.

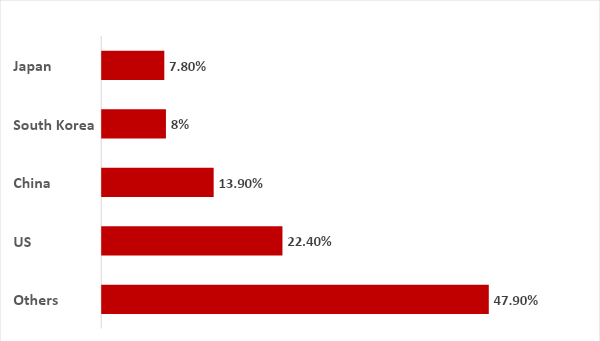

The US tops Vietnam’s export destination followed by China, South Korea, Japan and others.

The export growth has been spearheaded by the steep increase in exports of smartphone and parts followed by electronics, textiles, machinery. This has helped Vietnam position itself as an attractive FTA partner for developed economies to help them battle post pandemic economic recoveries

EU-Vietnam FTA

After the 2018 signing of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), largely heralded as one of the largest free-trade area in the world by GDP, Vietnam’s participation in the European Union FTA once again signals Vietnam’s growing bilateral popularity. The EU-Vietnam FTA came into effect in August 2020. The EVFTA makes Vietnam the second country in ASEAN and the first developing country in the region to sign an FTA with the EU. EVFTA is a new generation FTA, ensuring almost 99 percent elimination of custom duties between the EU and Vietnam. As per online sources, the FTA is expected to help increase Vietnam’s GDP by 2.4% by 2030. As an immediate effect of the agreement, Vietnam will cut 65 percent of import tax on EU commodities, while EU will cut more than 70 percent of tariffs on Vietnam’s commodities, while the rest will be abolished in the subsequent years. Notably, for the first eight months of 2020, the EU accounted for 16.7% of total export earnings, as per Vietnam government data, which is expected to rise steeply in the coming year.

Apart from boosting trade between EU and Vietnam (it is estimated that Vietnam’s export revenue to the EU will rise 42.7% by 2025 under the deal), the partnership is expected to bring many positive effects to the Vietnamese economy such as:

- making domestic production more competitive and encouraging innovation

- improving labor productivity

- opening up new markets to Vietnamese businesses by enhancing regional and global supply chains

- job and skill development

- enhancement of ancillary industries

- help increase FDI inflows from EU

- boost technology transfer

- greater choice basket for Vietnamese consumers

The trade deal gives the EU, which is battling a slowing economy, greater access to an attractive consumer market. Despite the pandemic and brakes on global economic activity, FDI inflows to Vietnam are likely to continue to be around USD 18 billion during the 2021-24 period, after reaching USD 16.9 billion in 2019 as per EIU reports. However, EU’s share in overall FDI into Vietnam has been low with the largest source of foreign investment coming from fellow Asian countries such as South Korea, Hong Kong, China, Singapore and Japan.

Post Brexit FTA with UK

In December 2020, UK and Vietnam inked its own FTA to continue trade relations as Britain leaves the EU in the new year. The deal is based on the terms of the EVFTA. Like the EVFTA, the UK FTA with Vietnam will also seek elimination of all customs duties, and apart from trade it also brings in significant opportunities in infrastructure, renewables and healthcare for both countries. The brisk pace of signing this deal by UK which is still grappling with Brexit matters, signals the growing importance of Vietnam in global trade.

Keen eye on other trade agreements

Vietnam is also part of the Regional Comprehensive Economic Partnership, which includes ASEAN countries as well as Australia, China, Japan, New Zealand and South Korea. The country is also seeking a trade deal with Israel and US in 2021 though the latter is bound to take longer. As recently in the first week of 2021, US has pledged to increase co-operation with Vietnam. With a new government in the US taking the reins, this bilateral relation has the potential to shift global trade power.

Challenges

However, despite the opportunities, Vietnam still face many challenges which if not addressed, can limit Vietnam’s moment of glory.

- Vietnamese businesses will need to comply with stricter standards such as branding, food safety, labeling, environment to comply with the FTA requirements

- Understanding the rules and regulations that governs Vietnam’s several trade agreements

- Ramping up production may be a challenge for Vietnam given that many industries still deal with out of date facilities and technologies.

- Vietnam is still a country suffering from weak institutions and teething problems of emerging markets such as bureaucratic hurdles

- Continued over reliance on China for raw material imports with 24% share of total import from China as Vietnam´s manufacturing sector continues to depend heavily on raw materials from China.

- A growing trade surplus with US which rose to USD 50.7 billion during the first ten months of 2020 compared with a trade surplus of USD 55.8 billion for 2019. This has resulted in increasing trade tensions with the US, which in October 2020, launched an official investigation into acts, policies, and practices by Vietnam alleging currency manipulation. There is a real risk of protectionism and tariffs being imposed by US following the investigation, which could hurt the Vietnamese economy.